It makes EPF one of the most tax-efficient investments. But the money in your PPF account can only be.

Mutual Funds Are The Best Option For Retail Investors Seeking To Grow Their Wealth Given The Hype About Mutual Funds Through An I Mutuals Funds Investing Fund

The value of the mutual fund invests stands at Rs.

. The registered nominee receives a lump-sum payment in the event of the death of the person insured during the period of the service. EPF comes under Employee Provident Fund and Miscellaneous Provisions Act1952. The Employee Provident Fund Organisation EPFO has provided a social security scheme called the Employee Pension Scheme EPS.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. Achieve your financial goals. He has the rights to receive the EPF funds of the deceased employee.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. Eligibility to Apply for EPF. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia.

So you dont need to pay a premium or contribute to EDLI. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. The current interest rate is 79.

1 lakh in a mutual fund scheme in January 2016. Absolute Returns Absolute Return of a mutual fund refers to the amount of total change in the value of a mutual fund investment at the time of redemption. This is the reason it is always best that EPF nomination should be your legal heir itself.

This scheme makes employees working in the organised sector to be eligible for a pension after their retirement at the age of 58 years. EPF is an excellent saving scheme for building a sufficient retirement corpus for salaried employees. Otherwise you will.

If you are a salaried individual and contributing to EPF scheme then you may be aware of EPFOs OTCP Online Transfer Claim PortalPF subscribers have been using this online portal for submitting online EPF transfer requests transfer of PF funds from previous EPF account to new EPF account. It falls under the EEE exempt exempt exempt category where the accrued interest and the amount accumulated on withdrawal are tax-free. Public Provident Fund is a government backed investment plan which will help its subscribers to enjoy risk-free investments for the long-term.

The Employee Provident Fund is open for employees of both the Public and Private Sectors which means all employees can apply to become a member of EPF India. Additionally any organisation that employs at least 20 individuals is deemed liable to extend the benefits of EPF to its employees. But the benefit of this scheme is added continuously under UAN.

There is a maturity period of 15 years under PPF. Calculators Budget Budget 2020 Income tax Investment Plan Tax Return Taxes Download Excel based Income Tax Calculator for FY 2020-21 AY 2021-22 incorporating new and existing tax regimeslabs. Choose the best investment option.

Equity Linked Savings Scheme ELSS Systematic Investment Plan SIP Systematic Withdrawal Plan SWP Retirement. EPF EPF Pension Scheme EPS And EPF Insurance EDLI Employees Deposit Linked Insurance Scheme or EDLI is an insurance cover provided by the EPFO. However he has no rights to claim the ownership of the fund.

EPF can be a good investment plan as it also. The EPF fund should be then distributed to legal heirs of the employee as per the legal heirs law. The interest rate on a PPF account is revised and paid by the Government every quarter.

The investment in the EPF Scheme gets a tax deduction up to a maximum of Rs 15 lakh per year under opt-out Section 80C of the Income Tax Act 1961. Take your Investment strategy to the next level using Growws online Financial planning Calculators for different investment methods. Over the career time one shifts a job multiple times.

However the EPFO has recently launched a new facility for. National Pension System NPS Employees Provident Fund EPF Atal Pension Scheme APS PM Shram Yogi Maan-dhan PM SYM PM Vaya Vandhana Scheme PM VVS Gratuity.

Uneedtrust Where Trust Is Mutual

Kwsp Epf Investment Ijan Unit Trust

General Information Epf I Invest Via I Akaun Principal Asset Management

Epf Member Investment Scheme For Unit Trust

How To Invest Public Mutual Fund Using Epf Malaysia Financial Blogger Ideas For Financial Freedom

Public Mutual Fund Random Thoughts

Epf Or Ppf Which One Should You Invest In Youtube

How To Invest In Unit Trust With Epf Money Kwsp I Invest I Sinar Youtube

Public Mutual Unit Trust Investments Home Facebook

Provident Funds Come In Two Kinds The First Is The Employees Provident Fund Or Epf And The Second Is The Public Prov Public Provident Fund Mutuals Funds Fund

Nps Vs Ppf Vs Epf Vs Mutual Fund Vs Elss Youtube Mutuals Funds Investing For Retirement Public Provident Fund

The Employee Provident Fund Epf Also Simply Called As Provident Fund Pf Is The Most Popular And Default Inves Financial Planning Private Sector Investing

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

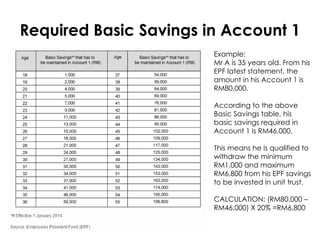

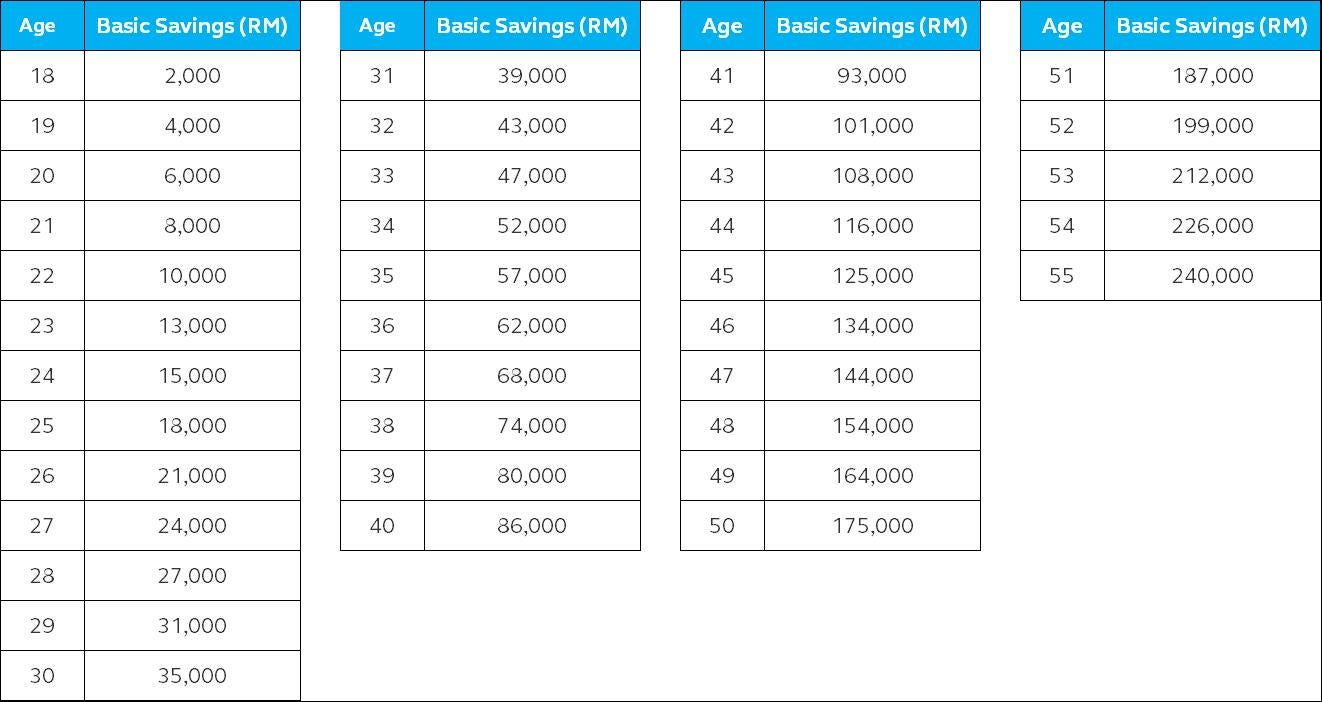

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

After Reducing Epf Interest Rate To 8 1 Epfo Wants Increase Equity Investment Limit To 25

Important Dates Deadlines For Aadhaar Linking With Pan Mutual Funds Insurance Policies Mobile Sim Investment In India Important Dates Mutuals Funds